Jet Hızında

Jet Hızında

Finansal Analiz

Mali tabloları yükleyin,saniyeler içerisinde finansal risk raporuna ulaşın.

- Bağımsız Denetim Raporu(PDF,SCAN)

- Kurumlar Vergi Beyannamesi(PDF,SCAN)

- Ara Dönem Beyannamesi(PDF,SCAN)

- Mizan(PDF,SCAN,EXCEL)

— Nedir?

JetScoring

Makine öğrenmesi algoritmaları ile her türlü mali tablodan veri toplayarak anlık risk raporları oluşturabilen bir finansal analiz platformudur.

Her türlü formattaki finansal belgeyi okur ve dijitalleştirir

Anında detaylı finansal analiz raporu oluşturur

Makine öğrenimi sayesinde şirketin gelecekteki likidite ve iflas durumunu tahmin eder

— Referanslarımız

— Özellikler

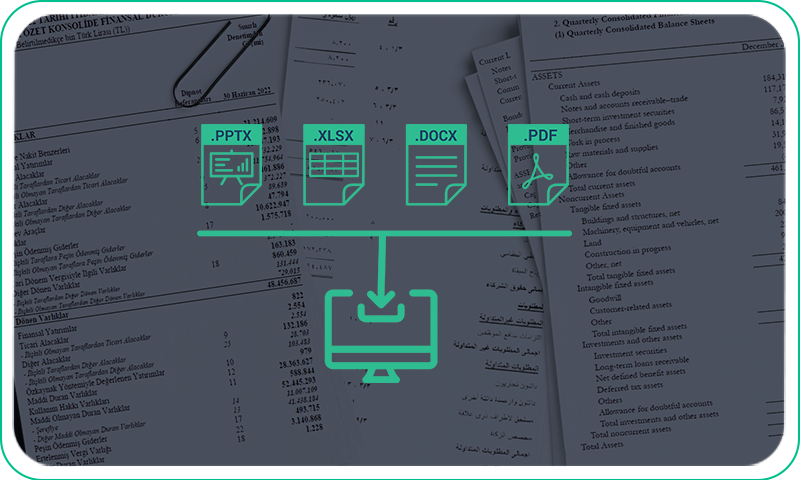

Format farketmeksizin aktarım yapabilen benzersiz algoritmik OCR teknolojisi

JetScoring, bağımsız denetim raporu, mizan, kurumlar vergi beyannamesi gibi mali raporları ve fatura, ticaret sicil gazetesi, vergi levhası gibi dokümanları okuyarak analize hazır hale getirir. Üstelik pdf, scan, excel fark etmeksizin yükleme yapabilirsiniz. Finansal verilerin otomatik aktarılmasıyla hem zaman kazanır hem de hatalı veri girişlerini önlersiniz.

— Özellikler

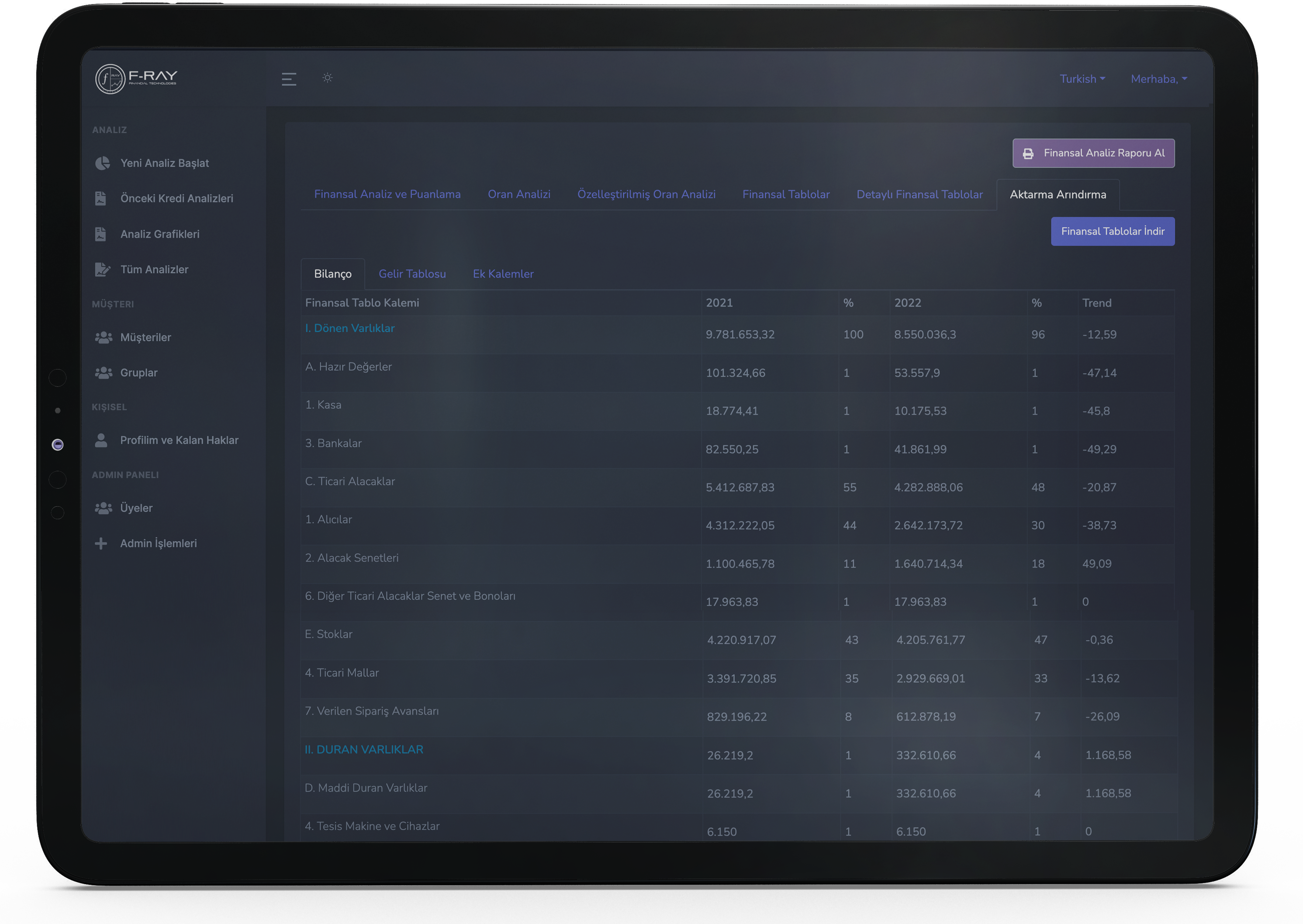

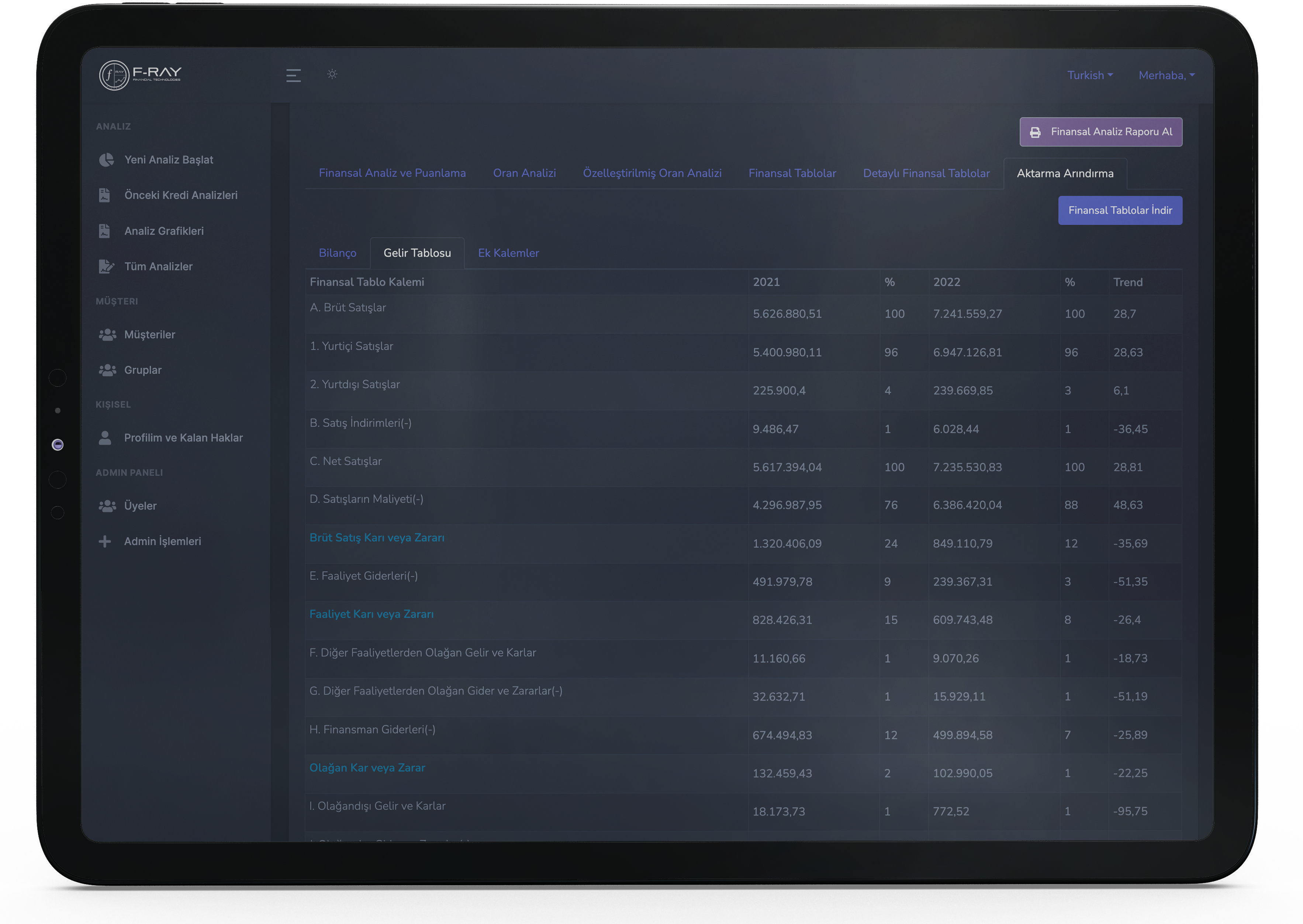

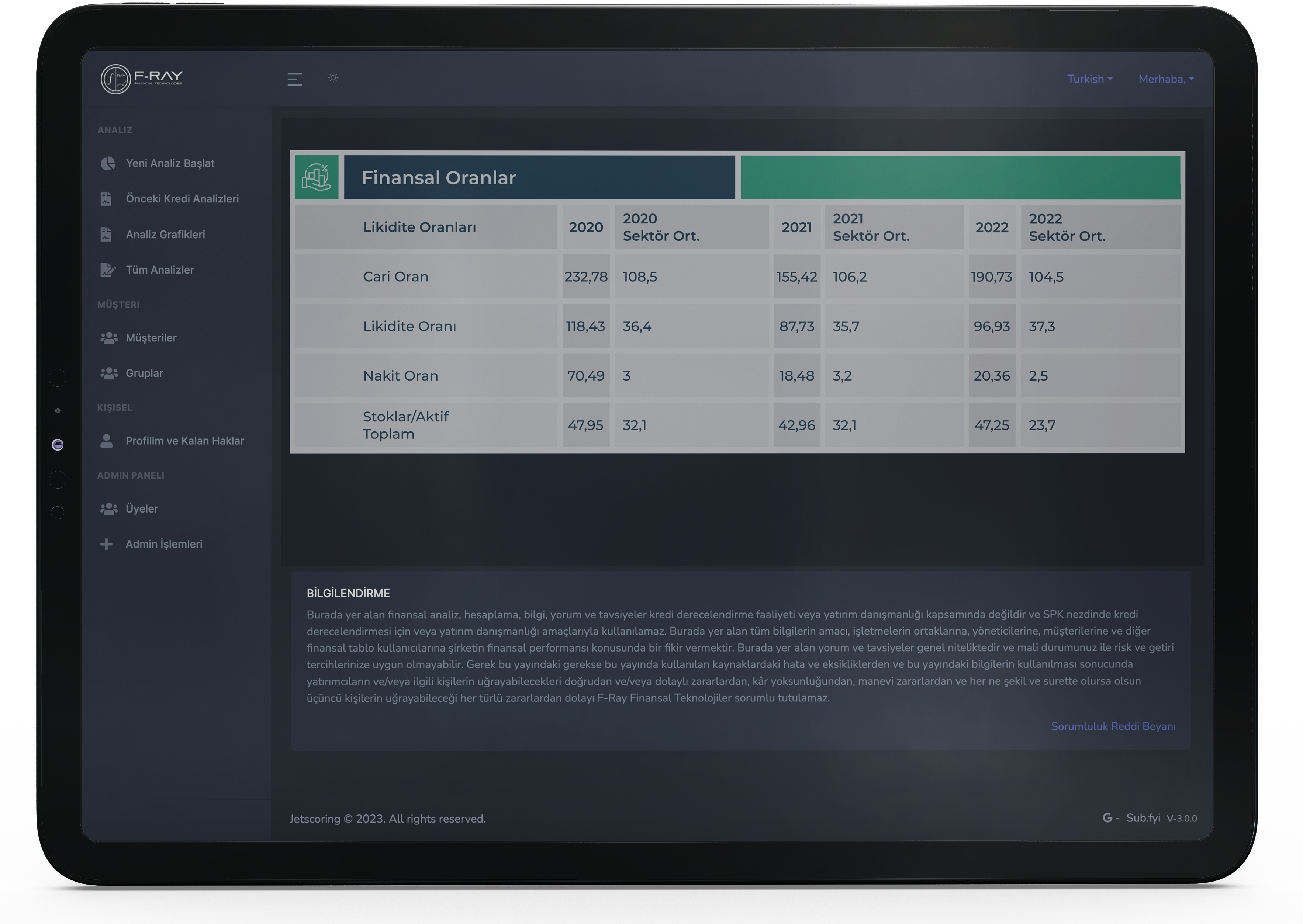

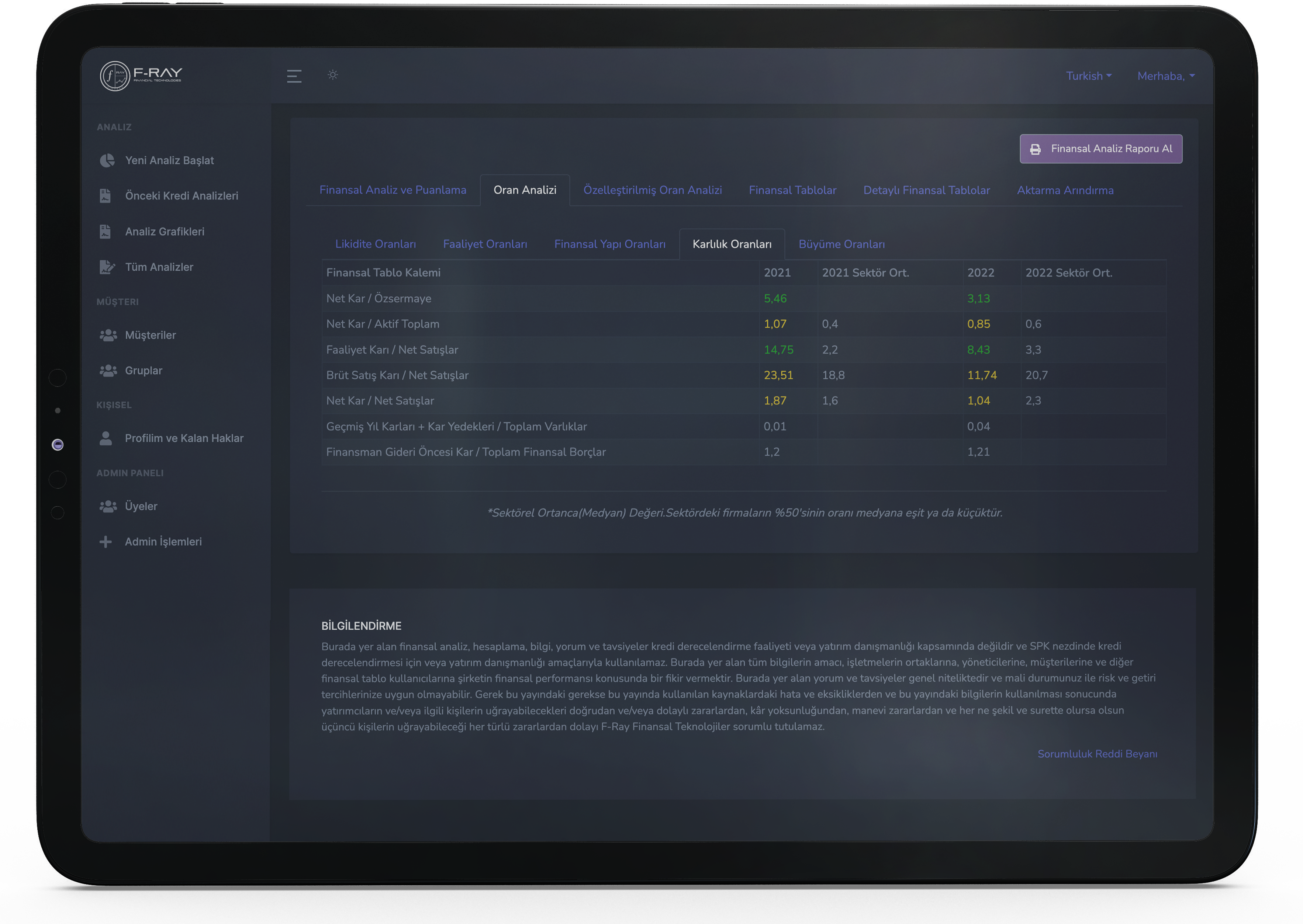

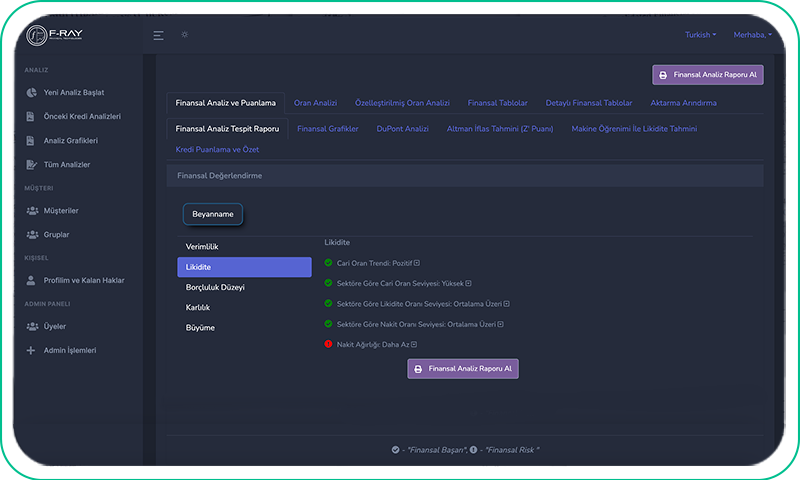

Sektör Kıyaslamaları ile Finansal Analiz

JetScoring bünyesindeki tüm analizler NACE kodlarına göre TCMB'den alınan sektör ortalamalarına göre yapılır. TÜBİTAK projesi kapsamında geliştirilen makine öğrenmesi algoritmalarınca şirketlerin gelecek riskleri anında tahminlenir.

— Özellikler

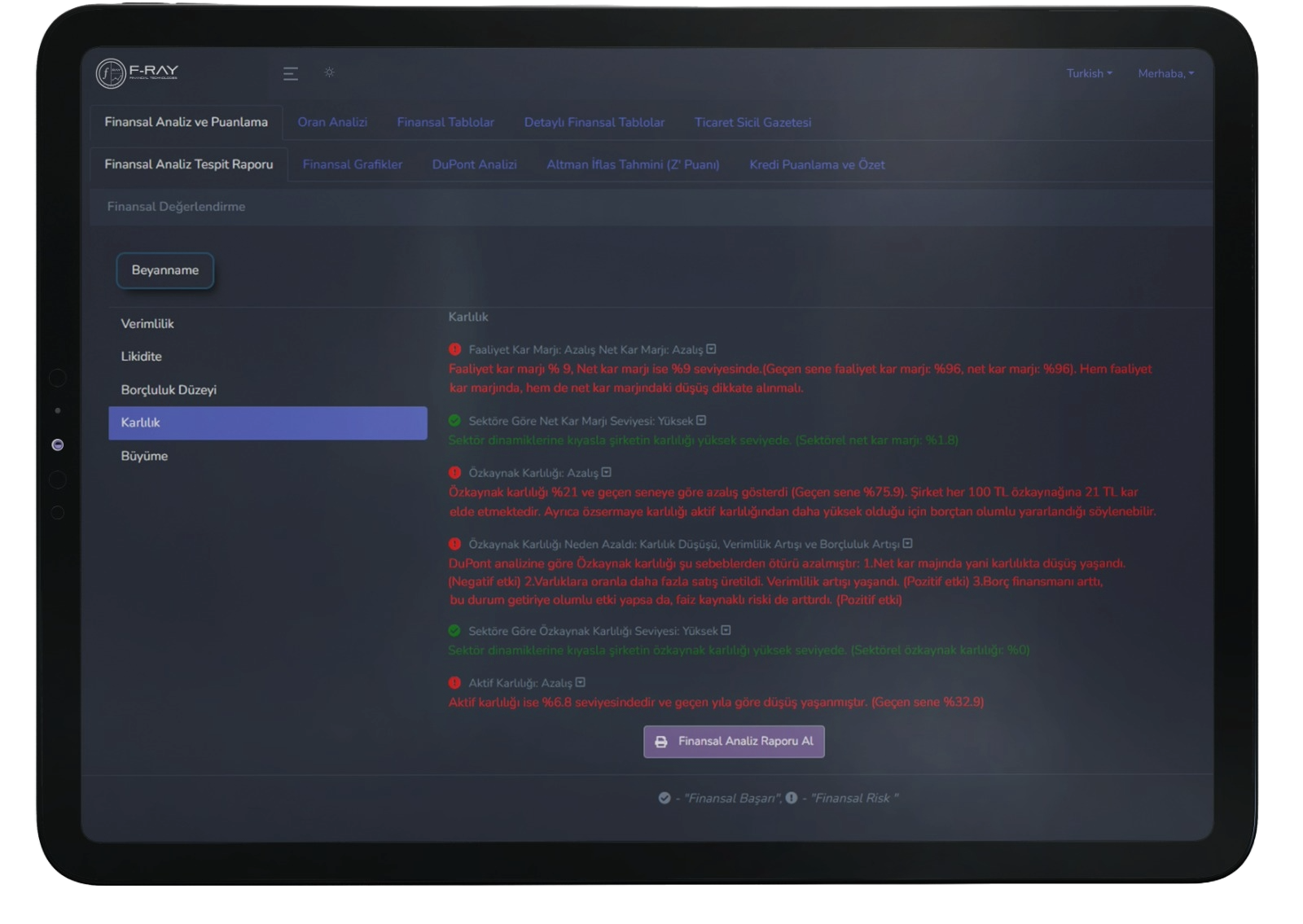

Anında Risk Raporu

JetScoring, 70'ten fazla finansal oran kullanarak şirketleri analiz eder ve anında finansal risk raporu oluşturur. Size sadece incelemesi kalır.

— Özellikler

Tüm Analiz İhtiyaçlarınıza Uygun Tek Çözüm

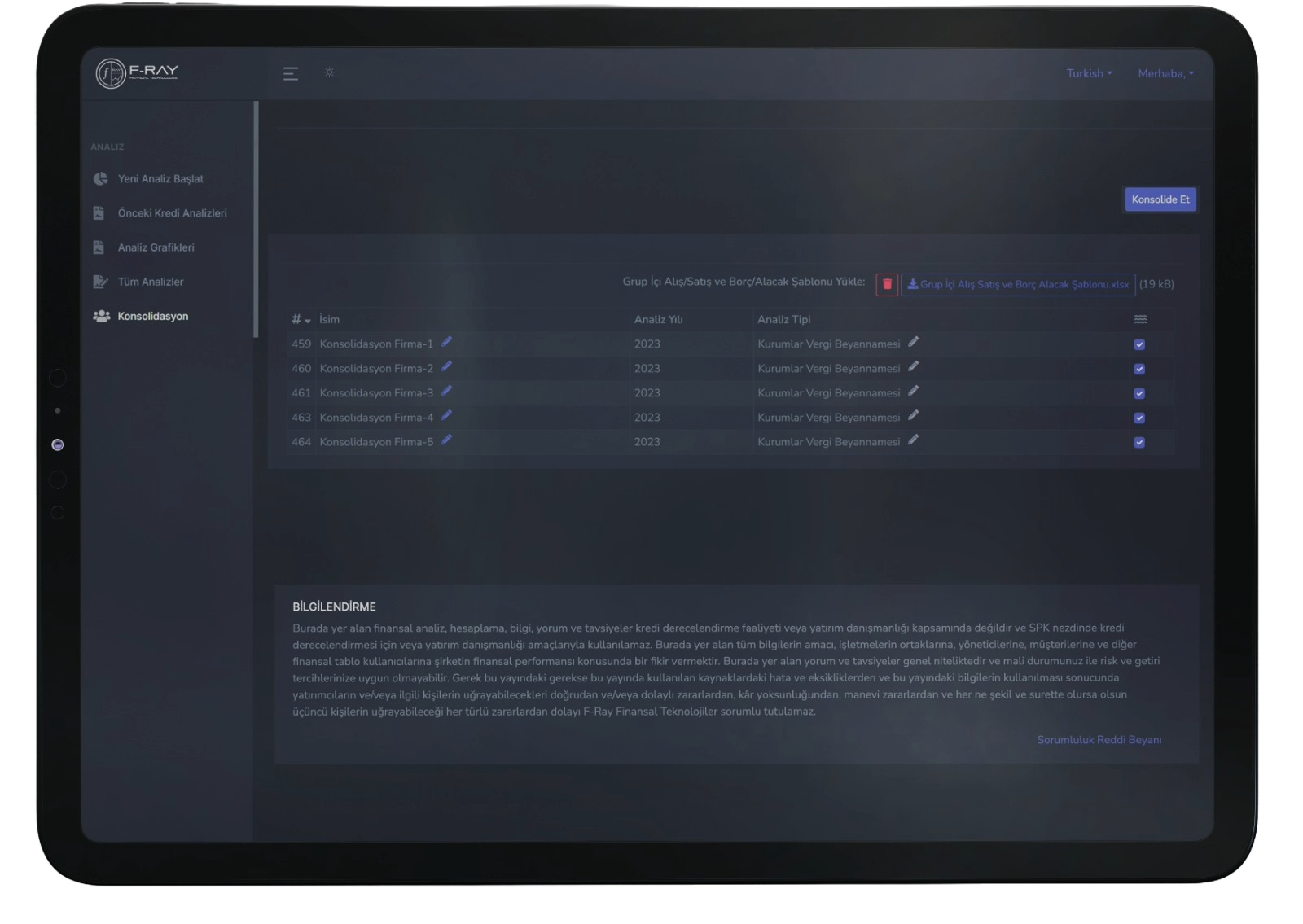

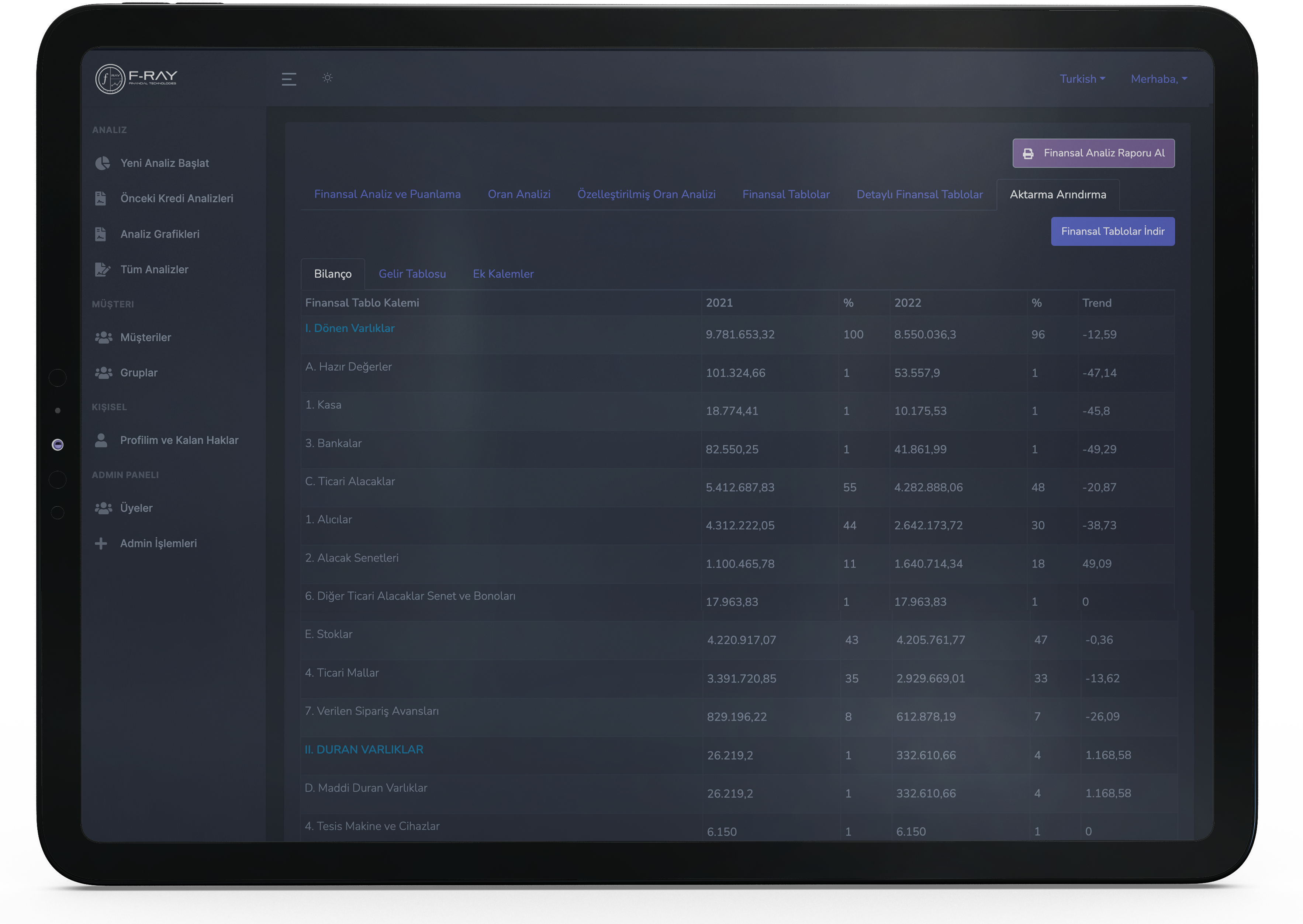

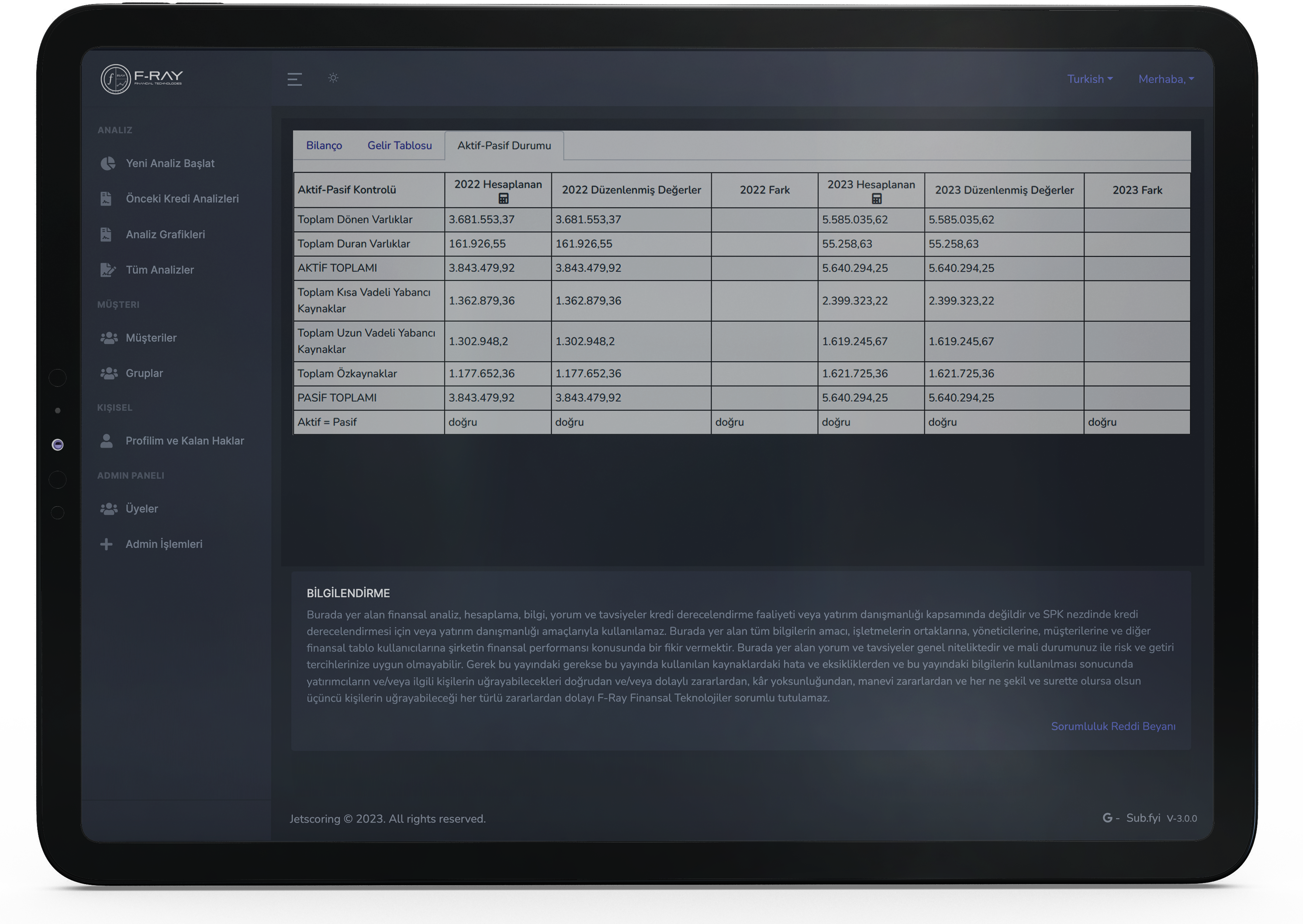

Mizan Analiz Modülü sayesinde aktif-pasif dengeli bilançolar oluşturabilir, Donuk Alacak Tespit Modülü ve Aktarma/Arındırma Modülü ile donuk alacakları ve diğer bilanço makyajlarını temizleyebilirsiniz. Konsolidasyon Modülü ile grup şirketlerinin konsolidasyon süreçlerini hızla tamamlayabilir, Düzenleme Modülü sayesinde istediğiniz zaman mali tablolarda düzenlemeler yapma imkanına sahip olursunuz.

— Nasıl Çalışır?

Saniyeler İçinde Finansal Analiz

JetScoring hızlı ve güvenilir finansal analiz raporu almanızı sağlayan en tasarruflu yöntemdir.

01

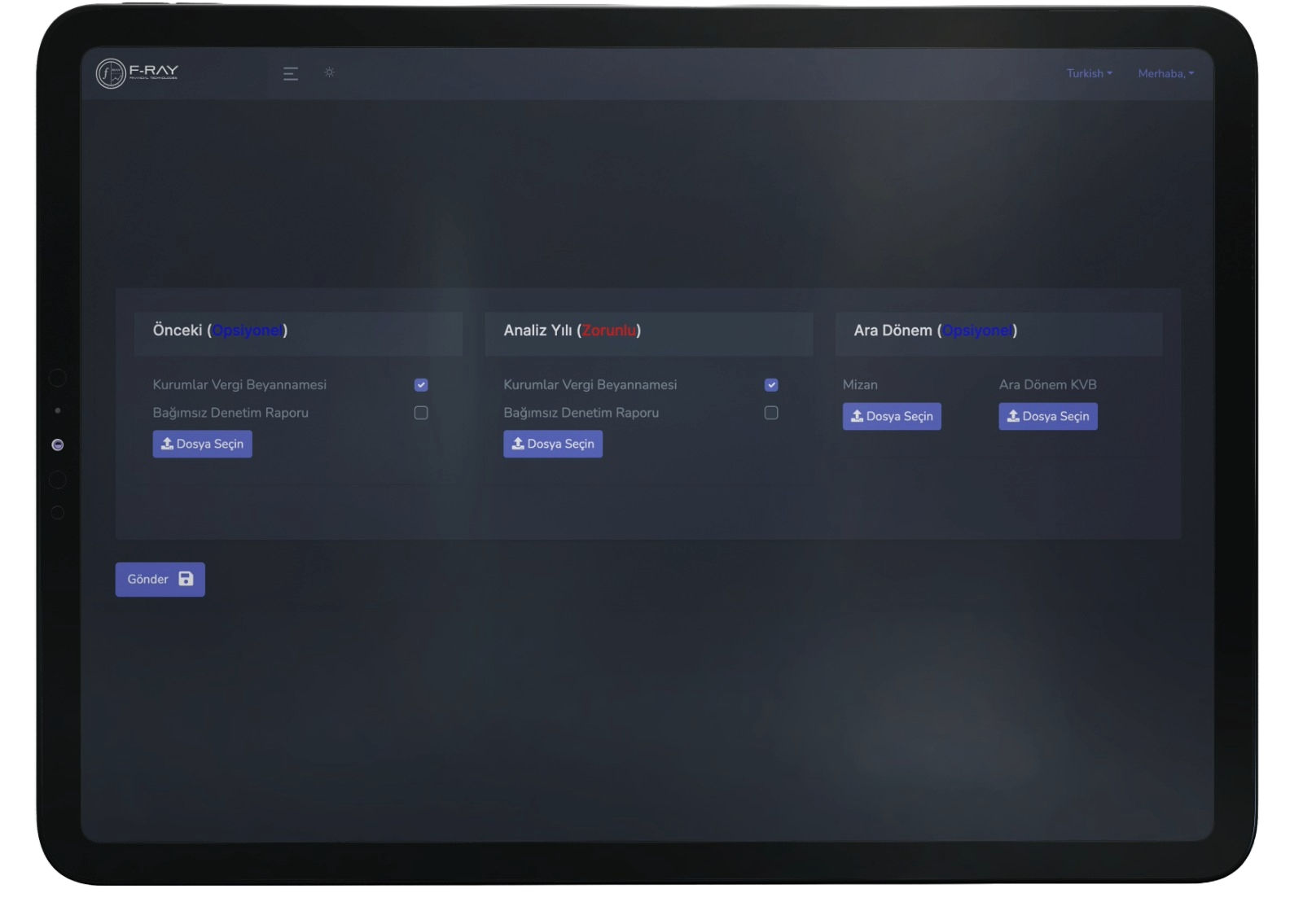

Müşteri/Tedarikçi Mali Tablolarını Yükleyin

02

Risk Raporunu Görüntüleyin

03

Verileri Direkt ERP'ye Aktarın

01

Müşteri/Tedarikçi Mali Tablolarını Yükleyin

Analizini yapmak istediğiniz şirketin pdf/scan/excel formatındaki mali tabolarını (bağımsız denetim raporu veya kurumlar vergisi beyannamesi / mizan) yükleyin.

Demo Talebi Oluştur

15 Dakikalık ücretsiz demo gösterimi ve hediye kontör kazanmak için hemen aşağıdaki formu doldurun.

Borsa Yatırımcısı Mısınız?

BIST şirketlerini algoritmik analizlerle inceleyebileceğiniz Borsa Analiz Platformumuzu ziyaret ederek yatırım fırsatlarını keşfedin.